-

-

Ujatcare.com Preffered Vendor Partnership with Caring.com

| May 20, 2022 -

Robots are taking over!

| Oct 26, 2022 -

Big Brother is Watching You

| Jan 13, 2023 -

Blogs Detalis

| Michael Kapoustin | Jun 20, 2023

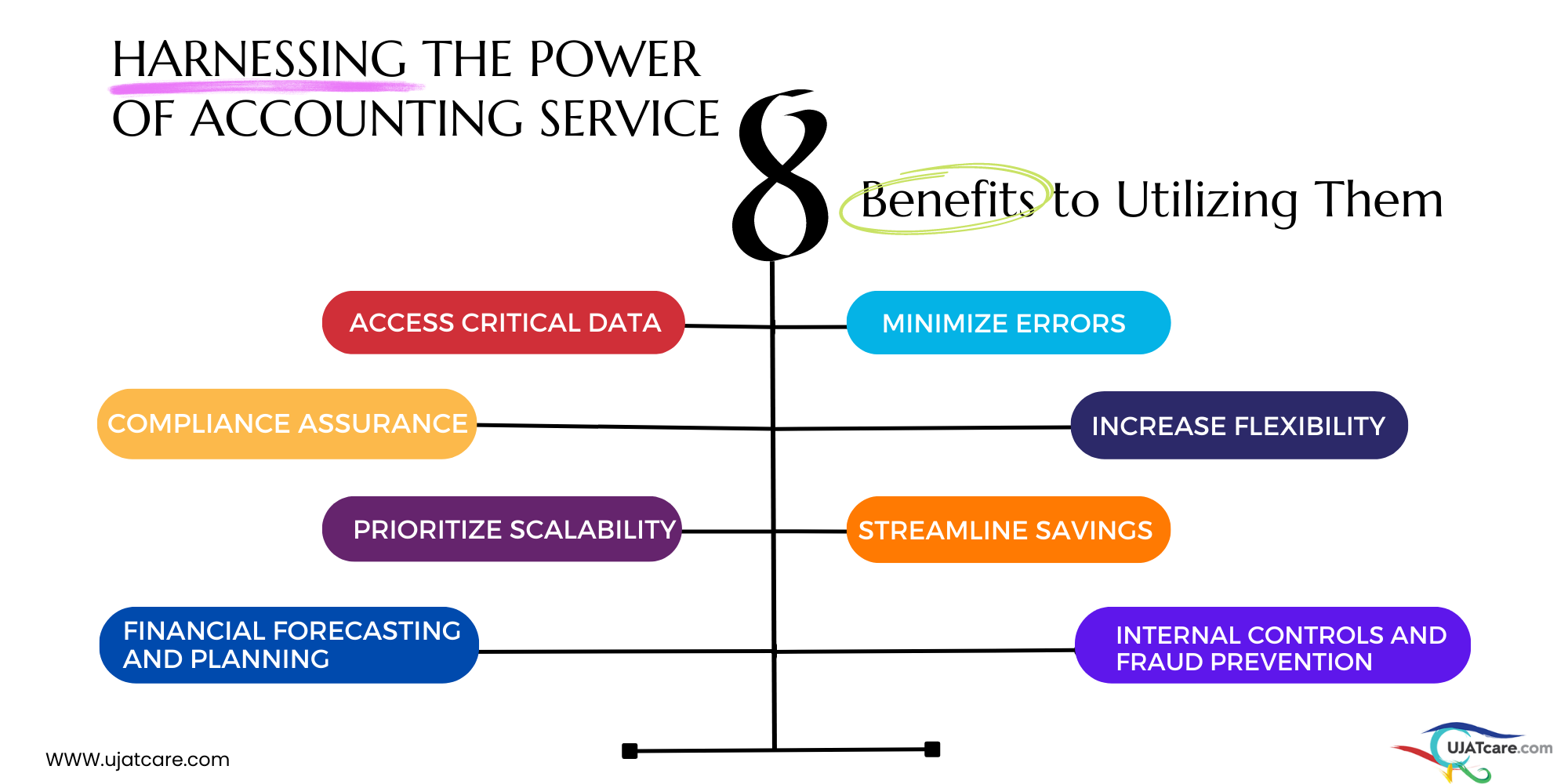

In the dynamic and competitive world of business, success requires a multifaceted approach. While strategies, innovation, and marketing play crucial roles, one often overlooked aspect that can truly unlock the full potential of a business is effective financial management. Harnessing the power of accounting services can be the hidden key to achieving sustainable growth, maximizing profitability, and ensuring long-term success.

Effective financial management is vital for businesses of all sizes and industries. While accounting tasks are an integral part of running a company, outsourcing accounting services offers numerous advantages that can significantly impact the bottom line. In this blog post, we will explore the various ways in which accounting services can empower businesses and provide them with a competitive edge.

1. Streamline Savings:

There is no denying that smart cost management is key to long-term success. By utilizing accounting services, businesses can optimize their financial resources and reduce unnecessary expenses that may hinder progress. Here's how accounting services help streamline savings:

- Outsourcing: Instead of investing in hiring, onboarding, and maintaining in-house accounting staff, businesses can outsource their accounting needs to qualified professionals, reducing overhead costs.

- Tailored Services: Accounting services offer flexibility, allowing businesses to choose the specific services that align with their needs and budget.

- Better Returns: By freeing up their financial department's key personnel from time-consuming tasks, businesses can prioritize initiatives that deliver better returns and contribute to broader organizational impact.

2. Minimize Errors

Even the most meticulous accounting professionals can make mistakes or overlook important details. However, accounting services provide the expertise and oversight necessary to minimize errors. Here's how accounting services can help minimize errors:

- Top Expertise: Accounting service providers have a team of professionals who are at the top of their field, with in-depth knowledge and experience in finance and specialized industries.

- Enhanced Oversight: With a dedicated team overlooking financial operations, errors can be quickly identified and corrected, ensuring accuracy and precision.

- Consistent Check-Ins: Regular communication and check-ins with the accounting services team allow businesses to detect and address potential issues before they impact the overall financial health.

3. Increase Flexibility:

In today's rapidly changing business landscape, flexibility is key to staying competitive. Accounting services offer businesses the flexibility they need to adapt and respond to evolving market conditions. Here's how accounting services contribute to increased flexibility:

- Centralized Accounting: By centralizing financial operations, businesses can eliminate the need to navigate between different departments, facilitating clear communication and creating an accessible chain of command.

- Real-time Financial Management: Accounting services provide businesses with the ability to manage financial assets in real-time, enabling quick decision-making and strategic adjustments for continued growth.

- Focus on Value-Adding Initiatives: By outsourcing accounting services, businesses can reclaim valuable time and resources, redirecting them towards more impactful projects and responsibilities that add value to the organization.

4. Prioritize Scalability:

As businesses grow, their accounting needs evolve as well. Outsourced accounting services offer scalability, eliminating the challenges associated with scaling an in-house accounting team. Here's how accounting services help businesses prioritize scalability:

- Avoiding Employee Turnover: Scaling an in-house team often involves hiring and retraining new staff members. By relying on outsourced accounting services, businesses can avoid the turnover-related disruptions and maintain continuity.

- Adaptation to Demand Fluctuations: With outsourced services, businesses can seamlessly adjust their accounting resources based on changing client demand, preventing resource shortages or excesses.

- Efficient Resource Allocation: Instead of reallocating internal resources for accounting-related tasks, businesses can rely on outsourced accounting services, ensuring the essential staff is available for other strategic initiatives.

5. Access Critical Data:

Data-driven decision-making is crucial for sustainable growth. Accounting services provide businesses with access to critical financial data, enabling informed decision-making and strategic planning. Here's how accounting services facilitate access to critical data:

- Data-Backed Reports: Accounting services generate reports based on revenue growth, profit ratios, liquidity, and other essential financial metrics, offering valuable insights into business performance.

- Advanced Technology Tools: Leveraging cutting-edge technology, accounting services streamline data analysis and reporting, providing businesses with accurate and timely financial information.

- Collaboration and Consultation: Businesses can consult with their accounting services team, gaining insights into the latest financial findings and trends, supporting effective decision-making.

6. Compliance Assurance:

Compliance with financial regulations is crucial for businesses, but navigating complex tax codes and industry-specific standards can be challenging. Accounting services ensure businesses maintain compliance. Here's how accounting services help ensure compliance:

- Expertise in Regulations: Accounting service providers possess deep knowledge of tax codes, government contract compliance, and industry-specific standards, ensuring businesses adhere to the necessary regulations.

- Comprehensive Support: Businesses can rely on accounting services to provide comprehensive compliance support, addressing specific compliance requirements unique to their industry.

- Risk Mitigation: By partnering with experienced accounting professionals, businesses can mitigate compliance risks, protecting their reputation and avoiding costly penalties.

7. Internal Controls and Fraud Prevention:

Accounting services help establish robust internal controls and prevent fraud within businesses:

- Financial Control Systems: Accounting services implement control systems, segregation of duties, and regular audits to ensure transparency and accountability.

- Fraud Risk Mitigation: By proactively identifying and addressing potential fraud risks, accounting services help businesses safeguard their assets and maintain trust with stakeholders.

8. Financial Forecasting and Planning:

Accounting services provide valuable insights for financial forecasting and planning:

- Revenue Projections: By analysing historical financial data and market trends, accounting services assist in developing accurate revenue projections.

- Budgeting and Planning: Accounting services offer support in budgeting, long-term financial planning, and identifying investment opportunities, enhancing financial stability, and facilitating growth.

Conclusion:

Accounting services offer a wide range of benefits that can significantly contribute to a business's financial success. From streamlining savings and minimizing errors to increasing flexibility and accessing critical data, businesses can leverage accounting services to optimize their financial operations and make informed decisions. Moreover, accounting services ensure compliance, provide valuable insights, and allow businesses to focus on core objectives for long-term growth and prosperity.

Accounting services are not just about balancing books and filing taxes; they are a powerful tool that can propel businesses towards success. By harnessing the expertise of professional accountants, businesses can streamline their financial operations, gain valuable insights, ensure compliance, and make informed decisions. Embracing accounting services as a strategic partner is the hidden key to unlocking the full potential of a business, driving growth, and securing a competitive edge in today's

business landscape.

For all your accounting needs, we are just a click or call away. At UJATcare, Our team of experienced accountants is here to provide you with expert guidance and support. Whether you require assistance with bookkeeping, financial statement preparation, tax planning, or any other accounting-related matters, we are ready to help. Simply fill out the contact form below or give us a call, and we will respond promptly to discuss your requirements and provide tailored solutions. Trust us to handle your financial needs while you focus on growing your business. Contact us today and experience the difference of professional accounting services.